If you’re feeling stressed or anxious today (etc.), give yourself 30 seconds and breathe with me:

You may have encountered the scientific benefits of breathing before. If you want to nerd out, here’s an article from Forbes and one from Harvard Health outlining how breathing intentionally does things like reducing anxiety, slowing heart rate, helping you regulate emotions, and affecting memory.

Be gentle with yourself and good to others this week.

By the talented Charlie Mackesy.

Once again, thank you from my heart and soul for your support, great senses of humor, brilliant minds, collaboration and what you're each doing to make the world a better place.

Cheers,

Where in the Virtual World is ConverSketch?

Indigenous Voices and Regenerative Foodscapes: Last week I graphically facilitated a session with Trees, Water, and People co-creating a vision for how we might bring more indigenous voices and stories forth to learn about food resilience and regeneration. I’m looking forward to planning and sharing what we create in the spring!

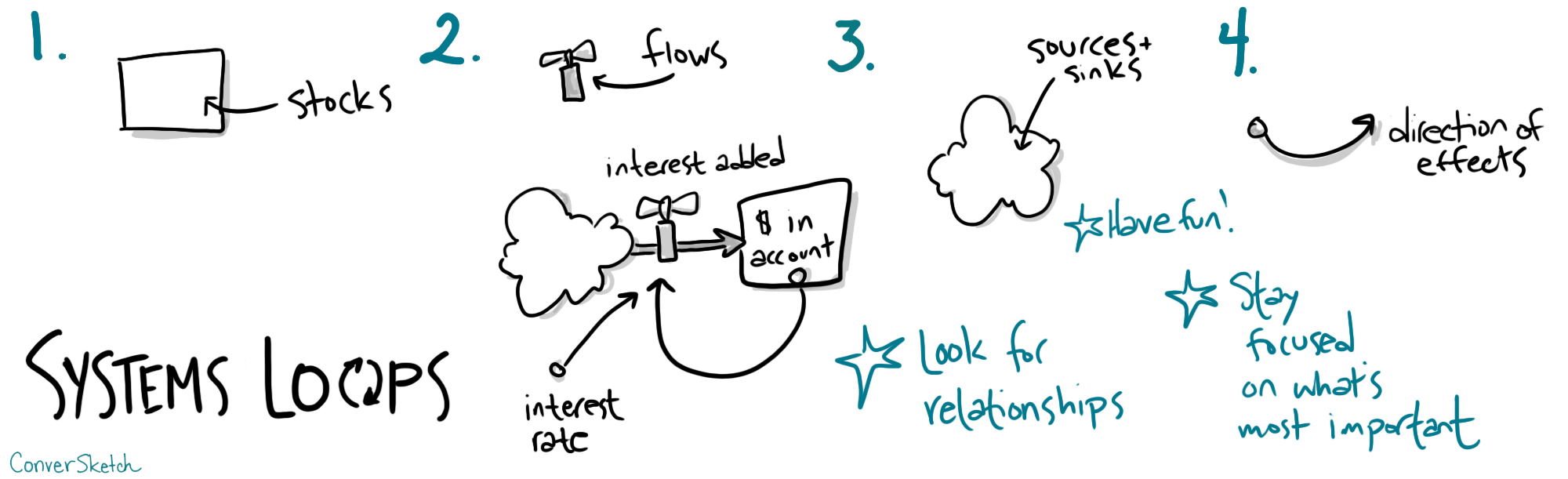

ShapingEDU Black Swan Thinking: ShapingEDU is back at it again with a series of online workshops around how to use systems thinking to predict, or at least be slightly less off-kilter when black swan events emerge. There are two more in the coming months – find out more here.

Boosting Women Leaders: How can companies support women leaders internally? Here’s a few tips from the McGuckin Group on boosting women leaders!

Live…in Greeley! I did my first on-site job for a strategic planning session for a local municipality. It felt great to be on the wall for the first time in seven months, and also strange with the realities of covid. I hope you are keeping well and taking care of yourselves!